FROM AN EXPERIENCE

1.Simplicity - Have a

simple, well defined way to generate trading ideas. Have a simple approach

towards the market. You can’t take everything into account when you try to make

an educated decision. Filter the noise and focus on several key market

components. For me, they are relative strength and earnings’ growth.

2. Common sense - create a trading system that is designed on the basis of proven trading anomaly. For instance, following the trend in different time frames.

3. Flexibility - be open to opportunities in both directions of the market. Be ready to get long and short.

4. Selectivity - chose only trades with the best risk/reward ratio; stocks with the best set ups; it doesn’t make sense to risk a dollar to make a dollar.

5. Don’t overtrade - two or three well planned trades in a week (month) might be more than enough to achieve your income goals. Patiently wait for the right set up to form and to offer good risk/reward ratio.

6. Exit strategy - Always, absolutely always have an exit strategy before you initiate a trade. Know at which point the market is telling you that you are wrong and do not hesitate to cut your losses short immediately. Don’t be afraid or ashamed to take a trading loss. Everyone has them. Just make sure that you keep their size to a minimum.

7. Let’s profits run - one or two good trades might make your month. One or two good months might make your year. Letting profits run is as important as cutting losses short. Bigger winners will allow you the luxury to be right in less than half of the trades and still be profitable.

8. Consistency - Stick to your method of trading ideas’ generation.

9. Specialize - Specialize in one or two distinct setups. It could be a combination of technicals and fundamentals, certain time frame or special event as a trading catalyst, certain sector or trading vehicle.

10. Have a plan - Which are the stocks that you will be paying special attention to – this week, today. Why those stocks? In which direction you expect them to continue their move? What will give you a clue for the beginning of the move? Follow them exclusively and enter without a hesitation when they give you a signal. Don’t just wake up and sit in front of your monitor without having a clue what you are going to trade today.

(to be contd)

Instead of reacting to market rumors, anecdotes or advice with a healthy dose of skepticism, many people not only believe, but also act on what they hear, supremely confident that they are able to discern fact from fiction. Thinking that they know more than they do, they express their opinion as fact on subjects they actually know little about. Because admitting you don?t know something is considered a sign of ignorance, people would rather pretend to be confident and live with the consequences of being wrong. Instead of listening, they talk. Instead of learning, they lecture. Instead of waiting patiently, they act speculatively.

2. Common sense - create a trading system that is designed on the basis of proven trading anomaly. For instance, following the trend in different time frames.

3. Flexibility - be open to opportunities in both directions of the market. Be ready to get long and short.

4. Selectivity - chose only trades with the best risk/reward ratio; stocks with the best set ups; it doesn’t make sense to risk a dollar to make a dollar.

5. Don’t overtrade - two or three well planned trades in a week (month) might be more than enough to achieve your income goals. Patiently wait for the right set up to form and to offer good risk/reward ratio.

6. Exit strategy - Always, absolutely always have an exit strategy before you initiate a trade. Know at which point the market is telling you that you are wrong and do not hesitate to cut your losses short immediately. Don’t be afraid or ashamed to take a trading loss. Everyone has them. Just make sure that you keep their size to a minimum.

7. Let’s profits run - one or two good trades might make your month. One or two good months might make your year. Letting profits run is as important as cutting losses short. Bigger winners will allow you the luxury to be right in less than half of the trades and still be profitable.

8. Consistency - Stick to your method of trading ideas’ generation.

9. Specialize - Specialize in one or two distinct setups. It could be a combination of technicals and fundamentals, certain time frame or special event as a trading catalyst, certain sector or trading vehicle.

10. Have a plan - Which are the stocks that you will be paying special attention to – this week, today. Why those stocks? In which direction you expect them to continue their move? What will give you a clue for the beginning of the move? Follow them exclusively and enter without a hesitation when they give you a signal. Don’t just wake up and sit in front of your monitor without having a clue what you are going to trade today.

(to be contd)

Instead of reacting to market rumors, anecdotes or advice with a healthy dose of skepticism, many people not only believe, but also act on what they hear, supremely confident that they are able to discern fact from fiction. Thinking that they know more than they do, they express their opinion as fact on subjects they actually know little about. Because admitting you don?t know something is considered a sign of ignorance, people would rather pretend to be confident and live with the consequences of being wrong. Instead of listening, they talk. Instead of learning, they lecture. Instead of waiting patiently, they act speculatively.

“Yet, I can see now that my

main trouble was my failure to grasp the vital difference between stock

gambling and stock speculation”. – Jesse Livermore

“I never buy anything unless

I can fill out on a piece of paper my reasons. I may be wrong, but I would know

the answer to that. “I’m paying $32 billion today for the Coca Cola Company

because …” If you can’t answer that question, you shouldn’t buy it. If you can

answer that question, and you do it a few times, you’ll make a lot of money.” –

Warren Buffet

“Any time you think you have

the game conquered, the game will turn around and punch you right in the nose.”

– Mike Schmidt

NIFTY LEVELS FOR MARCH 26

Day’s Supports @ 5298-62

Day’s Resistance @ 5342-63

If trades below 5297 for

5 minutes see slide upto 5262 is for sure

Below 5262 if it

sustains see more slide upto 5244

Suppose if cuts and trades

above 5298 for 5 minutes, a hike upto 5321 is seen.

Above 5322 for 5

minutes means 5342-52-62 is seen

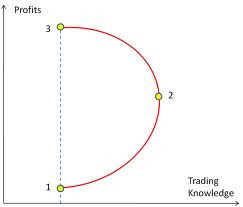

TRADING CURVE

I really like

this visual because if you turn your head enough it looks like a face hitting

the wall. Not sure if that was intentional but that is how I would best

describe what trading is like when you are new and/or struggling.

There are

subtle but important difference. Yes there are no clients or employees but that

means that you have to rely on your own feedback mechanisms. Money is not as

effective as one would think.

Initiation-

Every trader comes in thinking they will make money, in fact if they have never

traded, they probably have convinced themselves fully. They spend time looking

for all the answers in charts but it is in the process. It seems like easy

money. It is not easy but it is probably the best way to make money. The best

of anything takes more work.

Wearing off of

novelty- This is a critical time for any trader. This is where the hole gets

deeper or ideally the trader stops and starts to work more efficient. Process

and not charts. This is the motivation to understand what trading really is and

who they really are.

Trough of

sorrow- This is also a critical point. Now you have done some work but it has

not paid off yet. Do you keep working? Do you get some help? Can you continue

to improve?

Crash of

ineptitude- You are starting to gain some experience and confidence. But you

have a bad day and lose too much. Back to the drawing table.

Wiggles of

false hope- This is where you understand what not to do so you are floating

along again. The problem is you are only starting to understand what to do. You

have corrected the big mistakes and now start down the path of correcting the

small ones.

The promise

land- Now you understand what not to do and what to do. Now it is up to you to

actually do it. You are in the best position of your trading career.

Acquisition of

liquidity- Now you are a self sustaining trader. You have the ability to make x

amount of dollars to survive. This is what you have to lean on now. This is

when trading begins to get real. You are methodically improving.

Upside of

buyer- Not only do you understand what not to do and what to do, you always do

it. Now the sky is the limit. You control your destiny.

The difference

between trading and a start up is you are not looking to be acquired. You have

to do this day in and day out, make a career. This does not stop but the

process and progressions become second nature and you are seeing positive

results. This is not the time to relax but the time to put the foot on the gas

pedal. This is true about all of the stages except the first one.

Trading is

also different in that any day you can put yourself back into one of the

stages. That is why it is important to never forget that the purpose is to make

money. As you gain experience you will spend less time in the early stages. The

early stages will start to feel like touching a hot stove. You will recognized

the situations more quickly and have the strength to make a change immediately.

13 IMPORTANT RULES

R U L E # 1

Never, ever, under any circumstance, should one add to a losing position … not EVER!

Never, ever, under any circumstance, should one add to a losing position … not EVER!

Averaging down into a losing trade is the only thing that will assuredly take you out of the investment business. This is what took LTCM out. This is what took Barings Brothers out; this is what took Sumitomo Copper out, and this is what takes most losing investors out.

R U L E # 2

Never, ever, under any circumstance, should one add to a losing position … not EVER!

Never, ever, under any circumstance, should one add to a losing position … not EVER!

We trust our point is made. If “location, location, location” are the first three rules of investing in real estate, then the first two rules of trading equities, debt, commodities, currencies, and so on are these: never add to a losing position.

R U L E # 3

Learn to trade like a mercenary guerrilla.

Learn to trade like a mercenary guerrilla.

The great Jesse Livermore once said that it is not our duty to trade upon the bullish side, nor the bearish side, but upon the winning side. This is brilliance of the first order. We must indeed learn to fight/invest on the winning side, and we must be willing to change sides immediately when one side has gained the upper hand.

R U L E # 4

DON’T HOLD ON TO LOSING POSITIONS

Capital is in two varieties: Mental and Real, and, of the two, the mental capital is the most important.

Capital is in two varieties: Mental and Real, and, of the two, the mental capital is the most important.

Holding on to losing positions costs real capital as one’s account balance is depleted, but it can exhaust one’s mental capital even more seriously as one holds to the losing trade, becoming more and more fearful with each passing minute, day and week, avoiding potentially profitable trades while one nurtures the losing position.

R U L E # 5

GO WHERE THE STRENGTH IS

The objective of what we are after is not to buy low and to sell high, but to buy high and to sell higher, or to sell short low and to buy lower.

The objective of what we are after is not to buy low and to sell high, but to buy high and to sell higher, or to sell short low and to buy lower.

We can never know what price is really “low,” nor what price is really “high.” We can, however, have a modest chance at knowing what the trend is and acting on that trend. We can buy higher and we can sell higher still if the trend is up. Conversely, we can sell short at low prices and we can cover at lower prices if the trend is still down. However, we’ve no idea how high high is, nor how low low is.

R U L E # 6

Sell markets that show the greatest weakness; buy markets that show the greatest strength.

Sell markets that show the greatest weakness; buy markets that show the greatest strength.

Metaphorically, when bearish we need to throw our rocks into the wettest paper sack for it will break the most readily, while in bull markets we need to ride the strongest wind for it shall carry us farther than others.

R U L E # 7

In a Bull Market we can only be long or neutral; in a bear market we can only be bearish or neutral.

In a Bull Market we can only be long or neutral; in a bear market we can only be bearish or neutral.

In a bull market we can be neutral, modestly long, or aggressively long–getting into the last position after a protracted bull run into which we’ve added to our winning position all along the way. Conversely, in a bear market we can be neutral, modestly short, or aggressively short, but never, ever can we–or should we–be the opposite way even so slightly.

R U L E # 8

“Markets can remain illogical far longer than you or I can remain solvent.”

“Markets can remain illogical far longer than you or I can remain solvent.”

The University of Chicago “boys” have argued for decades that the markets are rational, but we in the markets every day know otherwise. We must learn to accept that irrationality, deal with it, and move on.

R U L E # 9

Trading runs in cycles; some are good, some are bad, and there is nothing we can do about that other than accept it and act accordingly.

Trading runs in cycles; some are good, some are bad, and there is nothing we can do about that other than accept it and act accordingly.

Thus, when things are going well, trade often, trade large, and try to maximize the good fortune that is being bestowed upon you. However, when trading poorly, trade infrequently, trade very small, and continue to get steadily smaller until the winds have changed and the trading “gods” have chosen to smile upon you once again.

R U L E # 10

To trade/invest successfully, think like a fundamentalist; trade like a technician.

To trade/invest successfully, think like a fundamentalist; trade like a technician.

It is obviously imperative that we understand the economic fundamentals that will drive a market higher or lower, but we must understand the technicals as well. When we do, then and only then can we, or should we, trade.

R U L E # 11

Keep your technical systems simple.

Keep your technical systems simple.

The greatest traders/investors we’ve had the honor to know over the years continue to employ the simplest trading schemes. They draw simple trend lines, they see and act on simple technical signals, they react swiftly, and they attribute it to their knowledge gained over the years that complexity is the home of the young and untested.

R U L E # 12

In trading/investing, an understanding of mass psychology is often more important than an understanding of economics.

In trading/investing, an understanding of mass psychology is often more important than an understanding of economics.

Markets are, as we like to say, the sum total of the wisdom and stupidity of all who trade in them, and they are collectively given over to the most basic components of the collective psychology. The dot-com bubble was indeed a bubble, but it grew from a small group to a larger group to the largest group, collectively fed by mass mania, until it ended. The economists among us missed the bull-run entirely, but that proves only that markets can indeed remain irrational, and that economic fundamentals may eventually hold the day but in the interim, psychology holds the moment.

And finally the most important rule of all:

R U L E # 13

Do more of that which is working and do less of that which is not.

Do more of that which is working and do less of that which is not.

This is a simple rule in writing; this is a difficult rule to act upon. However, it synthesizes all the modest wisdom we’ve accumulated over thirty years of watching and trading in markets. Adding to a winning trade while cutting back on losing trades is the one true rule that holds–and it holds in life as well as in trading/investing.

DISCLAIMER

THE RECOMMENDATIONS MADE HERE DO NOT CONSTITUTE AND OFFER TO SELL OF A SOLICITATION TO BUY ANY OF THE SECURITIES/COMMODITIES OF ANY OTHER INSTRUMENTS WHATSOEVER MENTIONED. NO REPRESENTATIONS CAN BE MADE THAT THE RECOMMENDATIONS CONTAINED WILL BE PROFITABLE OF THAT THEY WILL NOT RESULT IN LOSSES. READERS USING THE INFORMATION CONTAINED HEREIN ARE SOLELY RESPONSIBLE FOR THEIR ACTIONS. SURFING OR USING ‘tradersharmony.blogspot.com' DEEMS THAT THE SURFER ACCEPTS AND ACKNOWLEDGES THE DISCLAIMERS AND DISCLOSURES.THE INFORMATION PUBLISHED ARE FOR EDUCATIONAL AND INFORMATIVE PURPOSE ONLY AND THE USER/READERS SHOULD TAKE ADVICE OF HIS/HER ADVISER BEFORE TAKING ANY DECISION FOR BUYING, SELLING OR OTHERWISE DEALING WITH SECURITIES/COMMODITIES OR ANY OTHER INSTRUMENT WHATSOEVER.

.jpg)