FROM AN EXPERIENCE

TRY TO ANSWER THESE WITHIN AND PROVE YOURSELF

THAT YOU ARE A TRADER NOT A GAMBLER!!

THAT YOU ARE A TRADER NOT A GAMBLER!!

How many of you never seem to win consistently?

How many of you hold on because you did have some winning

days which means you have potential?

How many of you tell yourselves that its not an addiction,

its just a passion you have?

How many of you keep on replenishing your

trading accounts because just like any business,you always

lose money at the start?

trading accounts because just like any business,you always

lose money at the start?

How many of you tell yourselves your losses are the BEST THING

that ever happened because that's the best way to learn?

How many of you think of crafty ways to get some

extra money wired

extra money wired

into your trading accounts?

How many of you say you would have won if you only

“stuck to your discipline”?

&

How many of you are just waiting

FOR THAT SPECIAL DAY

FOR THAT SPECIAL DAY

WHEN EVERYTHING FINALLY CLICKS AND YOU’VE

FINALLY FOUND THAT EDGE?

How many of you fall into a depression and feel as if someone

has hit you in the heart with a hammer aftr a big loss.

&

How many of you cannot wait for the next day

to make some money back?

to make some money back?

My favorite:

“tomorrow is a new day and i will start fresh,

“tomorrow is a new day and i will start fresh,

a new trading style that will be disciplined”.

There are many guys that make lots of money trading for a living..

really, you seriously believe that?

“In The Trading Tribe, Ed Seykota extends his paradoxical insights about trading and life. ‘We need to experience our feelings. If we resist them, we wind up creating dramas in our lives and in our trading so that we have to experience them.’”

“Everyone knows traders who violate their rules, second guess their systems, give up on winners, stick with losers, and swear they won’t do it again…. Rather than counseling strength, steely discipline, or automation, Ed again turns apparent common sense on its head,. He encourages traders to embrace and celebrate their feelings, especially the ones they are unwilling to feel.”“‘Win or lose, everybody gets what they want from the market. Some people like to lose, so they win by losing money….’

YOU NEED TO BE RIGHT TO MAKE MONEY ?

- I DON'T THINK SO ALWAYS

You have to do the mental work to let go of the need to know

what is going to happen next or the need to be right on

each trade. In fact the degree to which you think you know,

assume you know, or in any way need to know what is going to

happen next, is equal to the degree to which you will fail as a

trader.

what is going to happen next or the need to be right on

each trade. In fact the degree to which you think you know,

assume you know, or in any way need to know what is going to

happen next, is equal to the degree to which you will fail as a

trader.

Mark Douglas

The most successful traders have found a way to inoculate

themselves from the stress of trading, and from the outcome of

their most recent trades. Here’s how they do it:

They have an unshakable belief in the fact that

themselves from the stress of trading, and from the outcome of

their most recent trades. Here’s how they do it:

They have an unshakable belief in the fact that

1) While the outcome of any given trade is uncertain they

believe in their edge over a series of trades. In other words

they know the expectancy of their method and have confidence

that over a series of random outcomes, the odds are in their favor.

believe in their edge over a series of trades. In other words

they know the expectancy of their method and have confidence

that over a series of random outcomes, the odds are in their favor.

2) Anything can happen! In other words they have learned to

think of every trade like tossing a coin – they don’t need

to know what will happen. They don’t expect to either win or

lose. This firm belief in the uncertainty of any given trade,

while knowing that over a series of trades you will be

profitable, is very liberating. When you learn the mental discipline

of letting go of the result of any individual trade you keep your

mind in a state where it can easily perceive the opportunities that

the market is offering. It is not distracted by focusing on your

expectations of what you think should happen – it can perceive

what is most likely to happen.

think of every trade like tossing a coin – they don’t need

to know what will happen. They don’t expect to either win or

lose. This firm belief in the uncertainty of any given trade,

while knowing that over a series of trades you will be

profitable, is very liberating. When you learn the mental discipline

of letting go of the result of any individual trade you keep your

mind in a state where it can easily perceive the opportunities that

the market is offering. It is not distracted by focusing on your

expectations of what you think should happen – it can perceive

what is most likely to happen.

The Body/Mind Connection

TODAY’S TRADING STRATEGY

OF NIFTY FUTURES – JAN 10

If breaks 5884 see a non-stop slide upto 5855

and then upto 5836-25

On the other side, if Nifty Futures does not breaks 5892,

manages to cross 5912 and sustain above the level

for 15-20 minutes see a hike upto 5950-60-80

If that too crossed with volume, see more hike upto 6003.

However, chances are very remote in this side today unless

a good gap-up opening occurs.

BANK NIFTY

Buy btwn 11094-121

T1 – 11165-87

T2 – 11200-09

T3 – 11236

Sell btwn 11005-10978

T1 – 10934-12

T2 – 10899-91

T3 – 10863

SHARE TIPS TODAY (JAN 10)

1) Sell ABAN @ 766

T1 – 761

T2 – 755

2) Sell BINANIND @ 241.90

T1 – 239.75

T2 – 238.50

3) Sell ACC @ 1001

T1 – 993.50

T2 – 987.80

4) Sell TATAMOTORS @ 1189

T1 – 1184-75

T2 – 1165

5) Sell GRAVITA @ 244

T1 – 241

T2 – 238

6) Sell SBIN @ 2597

T1 – 2585

T2 – 2575

7) Sell HINDALCO @ 233

T1 – 231.10

T2 – 230.10

8) Sell AXISBANK @ 1279

T1 – 1269

T2 – 1264-53

9) Sell LT @ 1844

T1 – 1834

T2 – 1830-25

10) Sell RELINFRA @ 828

T1 – 821.20

T2 – 816.20

11) Sell EXIDEIND @ 158.60

T1 – 156.50

T2 – 155.25

IMPORTANT THINGS TO BE NOTED

1. NEVER EVER COVER THE POSTION TILL TARGET1

IS ACHIEVED (TAKE YOUR OWN DECISION AFTER T1)

2.NEVER EVER ENTER INTO A TRADE

BEFORE THE ABOVE MENTIONED LEVELS

or AFTER THE TARGETS WERE ATTAINED.

3.STOPLOSS LEVELS, REVERSE TRADING

& MORE INTRADAY TIPS IN MARKET HOURS

EXCLUSIVELY TO THE SUBSCRIBERS

Disclosure:

Solely I have all the rights to stop the free trials

provided in this space at any moment.

Pls subscribe as soon as possible,

join hands with us and enjoy.

GOVT SECURITIES AUCTION DEVOLVES ON BOND HOUSE

A sharp rise in food inflation hit the auction for government securities worth Rs 11,000 crore today, forcing bond houses to buy unsold portion.

The government was to raise Rs 11,000 crore by selling three kinds of securities. The Reserve Bank of India, which conducted auction, fixed high cut-off yield points (low price) than market expectation.

The sharp rise in wholesale food inflation influenced market sentiment. Both led to partial devolve, dealers said. The three kinds of bonds on offer were bonds maturing in 2017 (7.49 per cent) for Rs 4,000 crore, bonds maturing in 2020 (7.80 per cent) for Rs 4,000 crore and those which are to be redeemed in 2027 for Rs 3,000 crore.

RBI accepted 33 bids amounting Rs 2,501.7 crore for bonds maturing in 2020. This would mean primary dealers (bond houses) who have under-written the auction, will have to purchase unsold bonds amounting Rs 1,460 crore. Also, in the case of 2017 bonds, bond houses would have to pick up bonds for Rs 723.50 crore.

The wholesale food inflation saw a sharp increase to 18.32 per cent for the week ended December 25, primarily due to a steep rise in onion prices. The inflation rate is at a 23-week high, much above the expectations of analysts and policymakers.

AN ASTRAL VIEW OF MARKET TODAY

Consider 10 minutes plus and minus in each prediction, and act

The dates of

high-volatility and

wide fluctuation

Nifty will catch an upward trend after 21-01-2011.

Disclaimer

The astrologer advises

you to compare the next

prediction with the

prediction of the

previous time slot.

you to compare the next

prediction with the

prediction of the

previous time slot.

The dates of

high-volatility and

wide fluctuation

in January-2011 are:

3 (23.10),

4 (Solar Eclipse) (-11.25),

4 (Solar Eclipse) (-11.25),

5 (-66.55), 7 (-143.65),

12, 12, 18, 24, 27, 31

12, 12, 18, 24, 27, 31

Nifty will catch an upward trend after 21-01-2011.

Till then it will hover in the consolidation area.

Today the market seems strong, but tomorrow's weightage is zero,

which you might have observed from the graph. Be cautious.

From today, Mars is in its exalted sign Capricorn and

Moon is in the Purva Bhadrapada Nakshatra of Rashi Meen.

Disclaimer

On repeated requests of the readers this astral prediction is started.

Traders are advised to attain some technical knowledge

before they get into trades anyway

-EDITOR

(Please refer to ‘OUR POLICIES’ in blog archives

before you leave the site)

before you leave the site)

For further details,

Contact Admin (Analyst) @

(0)9788563656

A (TRADERS) MUST WATCH FILM

After the trader has learned the mechanics of trading, we then enter into the world of Greed & Fear.

BUFFETT Vs SOROS

You must see this movie.

People lament the decline of the print news media, the victim of computer culture. The trading floors of the exchanges have also had a sharp decline in the number of floor traders who populate the floor, as the trading business is being increasingly facilitated by computers.

In 1992, there were 10,000 traders on the floors in Chicago, today there are only a few hundred and 95% of the volume is electronic. James Smith, the producer of “Floored,” the movie, examines the life of past and present traders both off and on the floor.

He discusses the culture, environment, wins, losses, personalities and future of traders, past and present. He pays close attention to the struggles the ex floor guys are having without the edge that the pit gave.

He examines the character of the players involved, and lets them reminisce about their floor days. He compares and contrasts the differences between local traders and computer traders. He interviews ex floor traders trying to make it on the screen.

He pays particular attention to the off floor lives of traders and gives them a free reign in telling their stories. The stories are great as everyone that was successful in the pit has a great story, and ego to boost.

The movie has many great shots of the action in the pits a few years ago and today. Many of the floor traders don’t realize that they’re subjects of the forces of natural selection, just like any other creature in nature.

One of the interviewees said that a big difference between watching the pit and watching a screen would be equivalent to watching an entire football game on TV or just watching the scoreboard. This, and many other observations bring clarity, and numerous trading lessons that might be useful to anyone interested in trading.

Also interesting to note is the obvious lesson in humility that is learned by ex-denizens of the trading pits. “Floored” is 87 minutes long, and can be found in its entirety in 8 segments, here.

(I highly recommend this movie to anyone interested in trading, futures, trading floors, etc. It’s a 150 year old way of life that’s sadly disappearing very quickly.)

Incidentally, for what it’s worth, there’s still some floor action in the cattle and hog markets, which have resisted the encroachment of electronic trading to some degree. Also, many options are still primarily traded by open outcry.

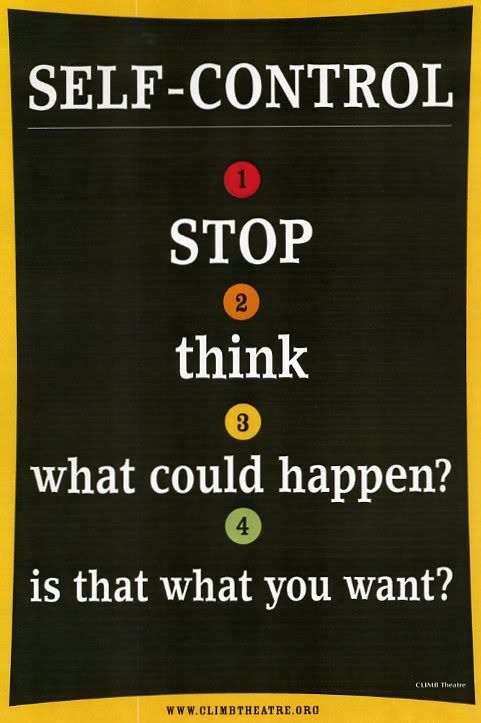

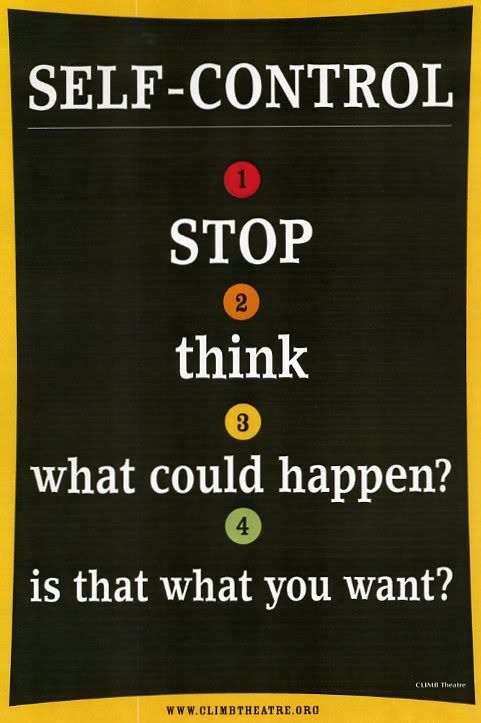

SELF CONTROL AND DISCIPLINE

After the trader has learned the mechanics of trading, we then enter into the world of Greed & Fear.

When you have your trading system in place, and know all about technical analysis, money management, probability, risk to reward and all the other components needed to be a successful trader, we are then introduced to our two friends Mr Greed and Mr Fear.

Greed and Fear = Emotions

It is sad to say this is the area that most traders cannot master, and if there was ever a secret attached to trading, this has to be one of the biggest, just behind money management.

If the trader can stay focused, and still show discipline to take the trades their system is generating after a string of losses then this is a quality that will result in becoming a great trader.

Most traders will be deeply affected after taking a few hits, and their discipline will waver by making changes to the plan. These changes mainly come in the form of exiting too early, cutting the trade’s potential for the need to be correct. Not realizing that doing this reduces the profits on the winners, and places the whole money management plan in jeopardy.

Handling a string of losing trades is not the only hazard because landing on a winning streak will places demands on your discipline.

A trader is most vulnerable when they start thinking this is easy, and start to take their foot off the pedal. Reading about some of the best traders in history reflects on some of my own experiences, that the biggest losses come very shortly after some of the biggest wins or a run of wins.

The fear factor will increase after every losing trade and the greed factor pops up after winners.

Very few traders are content with the results of every trade, they always think they could have won more on winners and reduced the amount on losers.

(Remember you will never find the tops and bottoms consistently, but all you need is that part in the middle to be profitable.)

Mr Fear and Mr Greed

Fear and greed, will play extraordinary tricks with your emotions but only through self control and discipline will you be able to control them.

Everybody has different levels of fear and greed, some people show no fear at all whatever they are doing, and then you get the others that are so greedy they will literally do anything. Having a balance between the two will be easier to control.

It`s without doubt, trading is a test of emotional control as the price swings up and down.

Without doing the ground work and arming yourself with the correct trading education, the diagram below highlights the emotions the trader will experience.

The only way we can control these emotions is to have complete faith in the system we are trading and understand that part of the system (plan) means that there will be losing trades.

To have undoubted faith in your trading system does not come cheaply in time and effort, the need for testing is really important. You should back test and forward test until you have conditioned your mind to accept all the possibilities that can be thrown at you.

Only then will you be able to dispatch Mr Fear and Mr Greed out of the equation, and trade with complete discipline.

But..?

How many traders will ignore this advice and jump in to soon, because of impatience and the lack of respect to their educational needs in conditioning their minds?

Self control and discipline is what makes a good trader, if they can hold their hands up at the end of the month and be true, by saying, I have traded my system without any deviation from the plan, then the future is looking good.

Trader’s that show discipline in their everyday life usually bring this quality to their trading business.

BUFFETT Vs SOROS

MESSAGE TODAY

-EDWIN LAND

RELAX CORNER

Once upon a time in a village, a man appeared and announced to the villagers that he would buy monkeys for $10 each. The villagers, seeing that there were many monkeys around, went out to the forest and started catching them.

The man bought thousands at $10 and as supply started to diminish, the villagers stopped their effort. He further announced that he would now buy at $20. This renewed the efforts of the villagers and they started catching monkeys again.

Soon the supply diminished even further and people started going back to their farms. The offer increased to $25 each and the supply of monkeys became so little that it was an effort to even see a monkey, let alone catch it!

The man now announced that he would buy monkeys at $50! However, since he had to go to the city on some business, his assistant would now buy on behalf of him.

In the absence of the man, the assistant told the villagers; "Look at all these monkeys in the big cage that the man has collected. I will sell them to you at $35 and when the man returns from the city, you can sell them to him for $50 each."

The villagers rounded up with all their savings and bought all the monkeys.

They never saw the man nor his assistant, only monkeys everywhere!

The man bought thousands at $10 and as supply started to diminish, the villagers stopped their effort. He further announced that he would now buy at $20. This renewed the efforts of the villagers and they started catching monkeys again.

Soon the supply diminished even further and people started going back to their farms. The offer increased to $25 each and the supply of monkeys became so little that it was an effort to even see a monkey, let alone catch it!

The man now announced that he would buy monkeys at $50! However, since he had to go to the city on some business, his assistant would now buy on behalf of him.

In the absence of the man, the assistant told the villagers; "Look at all these monkeys in the big cage that the man has collected. I will sell them to you at $35 and when the man returns from the city, you can sell them to him for $50 each."

The villagers rounded up with all their savings and bought all the monkeys.

They never saw the man nor his assistant, only monkeys everywhere!

Now you have a better understanding of how the FIIs works.

JUST SMS TO YOUR PAL

DISCLAIMER

THE RECOMMENDATIONS MADE HERE DO NOT CONSTITUTE AND OFFER TO SELL OF A SOLICITATION TO BUY ANY OF THE SECURITIES/COMMODITIES OF ANY OTHER INSTRUMENTS WHATSOEVER MENTIONED. NO REPRESENTATIONS CAN BE MADE THAT THE RECOMMENDATIONS CONTAINED WILL BE PROFITABLE OF THAT THEY WILL NOT RESULT IN LOSSES. READERS USING THE INFORMATION CONTAINED HEREIN ARE SOLELY RESPONSIBLE FOR THEIR ACTIONS. SURFING OR USING ‘tradersharmony.blogspot.com' DEEMS THAT THE SURFER ACCEPTS AND ACKNOWLEDGES THE DISCLAIMERS AND DISCLOSURES.THE INFORMATION PUBLISHED ARE FOR EDUCATIONAL AND INFORMATIVE PURPOSE ONLY AND THE USER/READERS SHOULD TAKE ADVICE OF HIS/HER ADVISER BEFORE TAKING ANY DECISION FOR BUYING, SELLING OR OTHERWISE DEALING WITH SECURITIES/COMMODITIES OR ANY OTHER INSTRUMENT WHATSOEVER.

No comments:

Post a Comment