FROM AN EXPERIENCE

Selecting the one or two super trades should

consume most of your time. There’s a great deal

of work and thinking to be done in comparing

markets, finding the best Open Interest play and

carefully reviewing the premiums.

The average tendency is to rush over this section

of trading simply because it seems more productive

to look at all the technical wiggle-waggles.

In actuality, as I’ve said so many times,

unless you are fundamentally right in your initial

selection decisions, all the technical tools

will do is get you in trouble.

Please devote all your concentration

and energies to the

selection of your commodities before

you give the technical data any consideration at all.

Technical data is secondary to screening out the

potential big winning trades.

The only technical tool to look at during this

screening is the ten week moving average trend line.

For a bullish situation it should be slanting up;

for a bearish market, it should be slanting down.

by Larry Williams

Want to believe a right thing in Market?

1) What goes up must come down and vice versa.

It's easier to find good stocks than to trade

them for a profit.

1. Seek favorable conditions for trade entry,

or stay out of the market until they appear.

Bad execution ruins a perfect setup.

2. Watch the tape before you trade. Look

for evidence to confirm your opinion.

Time, crowd and trend must support the reversal,

breakout or fade you're expecting to happen.

3. Choose to execute or to stand aside.

Staying out of the market is an aggressive way

to trade.

All opportunities carry risk, and even perfect

setups lead to very bad positions.

4. Filter the trade through your personal plan.

Ditch it if it doesn't meet your risk tolerance.

5. Stay on the sidelines and wait for the

opportunity to develop. There's a perfect

moment you're trying to trade.

6. Decide how long you want to be in the market

before you execute. Don't daytrade an investment

or invest in a swing trade.

7. Take positions with the market flow, not

against it. It's more fun to surf the waves than

to get eaten by the sharks.

8. Avoid the open. They see you coming, sucker.

9. Stand apart from the crowd. Its emotions

often signal opportunity in the opposite

direction. Profit rarely follows the herd.

10. Maintain an open mind and let the market

show its hand before you trade it.

11. Keep your hands off the keyboard until

you're ready to act. Don't trust your fingers until

they move faster than your brain, but still hit the

right notes.

12. Stand aside when confusion reigns and the

crowd lacks direction.

13. Take overnight positions before trading the

intraday markets. Longer holding periods reduce

the risk of a bad execution.

14. Lower your position size until you show a

track record. Work methodically through each

analysis, and

never be in a hurry.

15. Trade a swing strategy in range-bound

markets and a momentum strategy in trending

markets.

16. An excellent entry on a mediocre position

makes more money than a bad entry on a good

position.

17. Step in front of the crowd on pullbacks and

stand behind them on breakouts. Be ready

to move against them when conditions favor

a reversal.

18. Find the breaking point where the crowd

will lose control, give up or show exuberance.

Then execute the trade just before they do.

19. Use market orders to get in fast when you can

watch the market. Place limit orders when you

have a life outside of the markets.

20. Focus on execution, not technology.

Fast terminals make a good trader better,

but they won't help a loser.

As predicted in pre-market hours and titled

yesterday’s post did u feel a light tremor

in market

consume most of your time. There’s a great deal

of work and thinking to be done in comparing

markets, finding the best Open Interest play and

carefully reviewing the premiums.

The average tendency is to rush over this section

of trading simply because it seems more productive

to look at all the technical wiggle-waggles.

In actuality, as I’ve said so many times,

unless you are fundamentally right in your initial

selection decisions, all the technical tools

will do is get you in trouble.

Please devote all your concentration

and energies to the

selection of your commodities before

you give the technical data any consideration at all.

Technical data is secondary to screening out the

potential big winning trades.

The only technical tool to look at during this

screening is the ten week moving average trend line.

For a bullish situation it should be slanting up;

for a bearish market, it should be slanting down.

by Larry Williams

Want to believe a right thing in Market?

1) What goes up must come down and vice versa.

That’s Newton’s law, not the law of trading.

And even if the market does eventully self-correct,

you have no idea when it will happen.

In short, there’s no point blowing up your a

ccount fighthing the tape.

2) You have to be smart to make money.

No, what you have to be is disciplined. If you

want to be smart, write a book or teach at a

university. If you want to make money,

listen to what the market is telling you

and trade to make money — not to be “right.”

3) Making money is hard.

Nope. Sorry. Making money is actually easy.

Statistically, you’re going to do it about

half the time. Keeping it, now that’s the hard part.

4) I have to have a high winning

percentage to be profitable.

Not true. How often you are right on a trade is

only half of the equation. The other half is how

much do you make when you’re right and how

much you lose when you’re wrong. You can

remember that with this formula:

Probability (odds of it going up or down)

x Magnitude (how much it goes up or down)

= Profitability

5) To be successful, I have to trade without

emotions.

That is both wrong and impossible.

You are human so you have emotions.

Emotions can be a powerful motivator to your

trading.

When you feel angry or scared in trading,

take that emotion and translate it into

something more productive.

For example, if you’re feeling angry

because you just got run over by the market,

view that anger as a reason to be more

focused and disciplined in your entry and exit

levels on the next trade.

(to be contd)

It's easier to find good stocks than to trade

them for a profit.

1. Seek favorable conditions for trade entry,

or stay out of the market until they appear.

Bad execution ruins a perfect setup.

2. Watch the tape before you trade. Look

for evidence to confirm your opinion.

Time, crowd and trend must support the reversal,

breakout or fade you're expecting to happen.

3. Choose to execute or to stand aside.

Staying out of the market is an aggressive way

to trade.

All opportunities carry risk, and even perfect

setups lead to very bad positions.

4. Filter the trade through your personal plan.

Ditch it if it doesn't meet your risk tolerance.

5. Stay on the sidelines and wait for the

opportunity to develop. There's a perfect

moment you're trying to trade.

6. Decide how long you want to be in the market

before you execute. Don't daytrade an investment

or invest in a swing trade.

7. Take positions with the market flow, not

against it. It's more fun to surf the waves than

to get eaten by the sharks.

8. Avoid the open. They see you coming, sucker.

9. Stand apart from the crowd. Its emotions

often signal opportunity in the opposite

direction. Profit rarely follows the herd.

10. Maintain an open mind and let the market

show its hand before you trade it.

11. Keep your hands off the keyboard until

you're ready to act. Don't trust your fingers until

they move faster than your brain, but still hit the

right notes.

12. Stand aside when confusion reigns and the

crowd lacks direction.

13. Take overnight positions before trading the

intraday markets. Longer holding periods reduce

the risk of a bad execution.

14. Lower your position size until you show a

track record. Work methodically through each

analysis, and

never be in a hurry.

15. Trade a swing strategy in range-bound

markets and a momentum strategy in trending

markets.

16. An excellent entry on a mediocre position

makes more money than a bad entry on a good

position.

17. Step in front of the crowd on pullbacks and

stand behind them on breakouts. Be ready

to move against them when conditions favor

a reversal.

18. Find the breaking point where the crowd

will lose control, give up or show exuberance.

Then execute the trade just before they do.

19. Use market orders to get in fast when you can

watch the market. Place limit orders when you

have a life outside of the markets.

20. Focus on execution, not technology.

Fast terminals make a good trader better,

but they won't help a loser.

_____________________________________________________________________________________________________

yesterday’s post did u feel a light tremor

in market

in the midst of the previous session ?

Now what next?

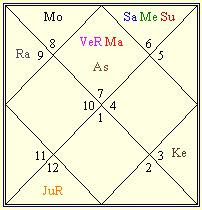

TODAY’S DAY TRADING

STRATEGY OF NIFTY FUTURES – OCT 13

Strong resistance @ 6186

NF should cross and sustain above 6138 atleast

for 15 minutes for some climbing upto

for 15 minutes for some climbing upto

6165-85

If crossed even 6187 with good volumes

more hike upto 6212-39

Otherwise if cuts yesterday’s low of 6083

A non-stop slide upto 6055-49-41

And then upto 6036-24

BANK NIFTY

Buy btwn 12537-55

T1 – 12583-98

T2 – 12607-12-30

Sell btwn 12477-59

T1 – 12431-16

T2 – 12407-02-84

Nifty, Bank Nifty levels and intraday news updated here gives astonishing success rate (more than 95%) that is more than enough for the readers to attain a decent profit daily.

To mint much more money pls subscribe our service and

enjoy daily market with our guidance.

Thank you.

SHARE TIPS TODAY

1) Sell BANKINDIA @ 547.8

T- 542.80

2) Sell NAUKRI @ 695.75

T1– 689.75

T2- 683.75

3) Sell TATASTEEL @ 632.50

T – 627.80

4) Sell HDFCBank @ 2375

T1– 2365

T2 – 2355

5) Sell BHARTIARTL @ 336.75

T1– 333.75

T2 - 330.75

6) Sell JSWSteel @ 1325

T – 1316

7) Sell AXISBANK @ 1541

T - 1531

(Please refer to ‘OUR POLICIES’ before you leave the site)

For further details,

Contact Admin (Analyst) @

(0)9788563656

I WANT YOU TO WATCH THIS DEAR FRIENDS.....

Markets Soar "But the World Is Worse Off," Jimmy Rogers Say @ Yahoo! Video

MESSAGE TODAY

Lack of confidence is what makes you want to change somebody

else's mind. When you're OK, you don't need to convince anyone else

in order to empower yourself.

-JADA PINKETT SMITH, Good Housekeeping

RELAX CORNER

JUST SMS TO YOUR PAL

A: No, not at all. Wine made from fruit. Brandy is distilled wine, that mean they take water out of fruity bit so you get even more of goodness that way. Beer also made of grain. Bottom up!

Q: Doctor, I’ve heard that cardiovascular exercise can prolong life. Is this true?

A: Your heart only good for so many beats, and that it…don’t waste on exercise. Everything wear out eventually. Speeding up heart not make you live longer; it like saying you extend life of car by driving faster.

Want to live longer? Take nap

---------------------------------------------------------------------------------------

DISCLAIMER

THE RECOMMENDATIONS MADE HERE DO NOT CONSTITUTE AND OFFER TO SELL OF A SOLICITATION TO BUY ANY OF THE SECURITIES/COMMODITIES OF ANY OTHER INSTRUMENTS WHATSOEVER MENTIONED. NO REPRESENTATIONS CAN BE MADE THAT THE RECOMMENDATIONS CONTAINED WILL BE PROFITABLE OF THAT THEY WILL NOT RESULT IN LOSSES. READERS USING THE INFORMATION CONTAINED HEREIN ARE SOLELY RESPONSIBLE FOR THEIR ACTIONS. SURFING OR USING ‘tradersharmony.blogspot.com' DEEMS THAT THE SURFER ACCEPTS AND ACKNOWLEDGES THE DISCLAIMERS AND DISCLOSURES.THE INFORMATION PUBLISHED ARE FOR EDUCATIONAL AND INFORMATIVE PURPOSE ONLY AND THE USER/READERS SHOULD TAKE ADVICE OF HIS/HER ADVISER BEFORE TAKING ANY DECISION FOR BUYING, SELLING OR OTHERWISE DEALING WITH SECURITIES/COMMODITIES OR ANY OTHER INSTRUMENT WHATSOEVER.