FROM AN EXPERIENCE

Is the money you risk on each trade real for you?

Do you really accept the amount of money you are risking

and are you willing to let it go?

I find it helps me to think of risk

as the amount of money I’m willing to spend to find out whether

my edge is going to work on this trade.

Note that I say spend.

I actually think of each trade as though I’ve purchased a

lottery ticket. I think that the amount of my stop has already

been paid to find out if the edge works, so that as the trade

proceeds I’m not afraid to lose anything.

This is why the first point about knowing your expectancy

is so important – if you trust your expectancy over a series

of trades you don’t have to be afraid of the outcome of any

single one.

People lose money in the markets because the person

who places the trade very often is not the same person who

manages and closes the trade. Quite literally another self has

taken over–another mind .

Do you think of each trade as an island, as the great hope,

or do you think in terms of probabilities over a series of trades?

Casinos make their money by keeping the odds

in their favor over a

large number of bets. And that’s how successful traders think too.

They don’t get attached to the success or failure of any given trade.

Their primary goal is to stay calm,

relaxed and open to the market’s

opportunities so that they can execute

their edge precisely and

keep the odds in their favor.

Thats why I make such a big deal about

emotional clearing

and staying calm. The emotional clearing technique

I use is literally worth tens of thousands of dollars

to me in bottom line results.

One of the easiest mistakes any trader can make is not a

‘trading’ mistake at all. Rather, the mistake is complacency

with his or her trading skills and knowledge.

Unfortunately, trading is not like riding a bike – you

can (and will) forget how. Obviously you’ll always

know how to enter orders, but the efficiency and accuracy

of your trading will diminish without constant renewal of your

trading mindset.

The reason that most traders don’t undergo psychological

self-development is a lack of time, and that’s understandable.

However, a good book, DVD or Coaching Class is actually

an investment in yourself, and ultimately an investment

in your bottom line. Today as a primer, and a challenge,

I’d like to review

some self-development concepts that Ari Kiev explores

in his book ‘Trading To Win, The Psychology Of Managing

The Markets‘. This in no way is a substitute for his excellent book,

but they are still useful ideas even in this abbreviated form.

None of them are going to be new to you, but all of them

will be valuable to you.

1. Plan the entire trade before you enter the trade.

Have an entry strategy, and an exit point

(both a winning exit point and a non-winning

exit point).

This will inherently force you to look

at your risk/reward ratio.

Write these entries and exits down in a journal.

2. Eliminate distractions.

It’s difficult enough to find trading time at all if it’s not your regular job.

If you’re a part-time trader who

trades at work between meetings

and phone calls, think about this:

there are full-time professional traders

who are concentrating on nothing

other than taking your money.

It’s not that they’re better or smarter than you – they

just have the time to focus.

If you must trade, set aside blocks of time to study

or trade without distraction.

Or it may be more feasible to do your trading

on an end-of day basis, meaning you

place your orders and do your ‘homework’

the night before when you can

focus on it.

3. Choose a method or a small group of methods,

and stick to them.

Far too often we see a trader adopt a

new indicator or signal only to see it backfire.

Become a master of your favorite signals, rather than a

slave to any and every signal. Understand that an indicator

will fail sometimes. That’s ok. The sizable winning trades

should more than offset the small losing trades initiated by

an errant signal. This trading method is designed to

eliminate the emotional bias of trading.

(to be contd)

Dear Readers,friends,

You would have noticed the Nifty levels

and Bank Nifty levels updated here

were perfect till now

and you would have also checked the

directions (+ve or – ve),

piercing the targets without hitting any stoploss.

Last month and August (out of 40 trading days)

36 days went in profit but the stock trading tips

given below has the success ratio of 100%

till now to everyone’s surprise.

Now check this too pals.

TODAY’S DAY TRADING STRATEGY

OF NIFTY FUTURES – OCT 11

Resistance @ 6155-85

If trades above 6155 for 15-20 minutes

we can see a hike upto 6175-82

Support @ 6134

Break below this slides NF to 6118-6088

BANK NIFTY

Buy btwn 12557-76

T1 – 12606-22

T2 – 12636-56

Sell btwn 12494-75

T1 – 12445-29

T2 – 12414-395

Nifty, Bank Nifty levels and intraday news updated here gives astonishing success rate (more than 95%) that is more than enough for the readers to attain a decent profit daily.

To mint much more money pls subscribe our service and

enjoy daily market with our guidance.

SHARE TIPS TODAY

1) Sell TATASTEEL @ 625

T1 – 620

T2 - 615

2) Sell LICHSNG @ 1411

T1 – 1404

T2 – 1394

3) Sell JHS @ 105

T1 – 103.40

T2 – 99.40

4) Sell JSWSteel @ 1329

T – 1319

5) Sell JPASSOCIATES @ 131.50

T1 – 130.5

T2 – 129.5

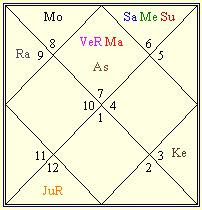

ASTRAL PREDICTION

11th October 2010 to 15th October 2010

Planetary position during October 2010

Sun will transit from Virgo sign.

Mercury will transit from Virgo sign.

Venus will transit from Libra.

Moon will transit from Scorpio, Sagittarius and Capricorn.

Mars will transit from Libra.

Rahu will transit from Sagittarius.

Jupiter will transit from Pisces. Jupiter will retrograde.

Saturn will transit in Virgo.

Ketu will transit in Gemini.

Stock Market Prediction for 11th October 2010

Transiting Moon will be passing through Scorpio Zodiac sign. Transiting Moon will be in applying aspect with Transiting Rahu, which indicates Market may do business in green signal, but profit booking will be seen at higher levels. Market trend may change after 10.45. Market would gradually go Flat/up. Market may try to go up between 09.55 and 10.24. Market may go flat or up during last trading session.

Disclaimer

On repeated requests of the readers this astral prediction is started.

Traders are advised to attain some technical knowledge before they get into trades anyway

-EDITOR

UNEXPECTED EVENTS THAT CAN DAMAGE YOUR PORTFOLIO

If the gulf oil spill as taught us anything is that

unexpected events can occur at anytime and can

drastically deteriorate the stock value of an

otherwise dominantly place company,

as seen with British Petroleum (BP).

In the end, there is really nothing we can do

about these unexpected events as investors

don’t think a massive oil spill is about to happen;

however, the truly prudent, cautious, and somewhat

boring traders can try to avoid companies with

where unexpected events can happen.

Make sense?

I have tried to compile a list of potential unforeseen

events that can drastically impact a stock, sector,

or market overal. Feel free to list some others in the comments section below.

1. Violence – War, terrorist attacks, and other acts

of violence can often impact the entire market.

Violence generally always revolves around

resources and inputs that can harm several material

and commodity stocks.

2. Natural Disasters – Nobody wakes up expecting

an entire city to be flooded or volcanic ash to

takeover nearly half a continent, but it happens

and can impact all stocks with exposure to that

area. See the top 10 environmental payouts.

3. Fraud – While the very astute trader may be

able to connect the dots, more often that not,

most traders won’t know about any act of fraud

until it has been made public. By then, it usually

too late. Generally these type of events impact the

individual stock and, in the short-term,

close competitors.

4. Product Defects/Recall – Even the best of the

businesses make a faulty product. Whether it be an automobile manufacturer that recalls a certain

model, a medical stock with bad side effects,

or a toy company that used harmful inputs, generally manufactured-based goods are at risk

for these events.

5. Outages – While weather can be at fault,

there are occasions when energy companies

experience unexpected outages that span over

a wide range of customers. Generally this leads to

loss in revenue and increased expenses,

which doesn’t show up well in the earnings report.

What are some other unexpected events that

can harm stocks?

(Please refer to ‘OUR POLICIES’ before you leave the site)

For further details,

Contact Admin (Analyst) @

(0)9788563656

MESSAGE TODAY

The man who is unhappy will, as a rule, adopt an unhappy creed, while the man who is happy will adopt a happy creed; each may attribute his happiness or unhappiness to his beliefs, while the real causation is the other way round.

-BERTRAND RUSSELL, The Conquest of Happiness

RELAX CORNER

JUST SMS TO YOUR PAL

Interviewer asked sardarji:

Which are the 2 latest versions of java?

Sardarji: Marjava & Mitjava

DISCLAIMER

THE RECOMMENDATIONS MADE HERE DO NOT CONSTITUTE AND OFFER TO SELL OF A SOLICITATION TO BUY ANY OF THE SECURITIES/COMMODITIES OF ANY OTHER INSTRUMENTS WHATSOEVER MENTIONED. NO REPRESENTATIONS CAN BE MADE THAT THE RECOMMENDATIONS CONTAINED WILL BE PROFITABLE OF THAT THEY WILL NOT RESULT IN LOSSES. READERS USING THE INFORMATION CONTAINED HEREIN ARE SOLELY RESPONSIBLE FOR THEIR ACTIONS. SURFING OR USING ‘tradersharmony.blogspot.com' DEEMS THAT THE SURFER ACCEPTS AND ACKNOWLEDGES THE DISCLAIMERS AND DISCLOSURES.THE INFORMATION PUBLISHED ARE FOR EDUCATIONAL AND INFORMATIVE PURPOSE ONLY AND THE USER/READERS SHOULD TAKE ADVICE OF HIS/HER ADVISER BEFORE TAKING ANY DECISION FOR BUYING, SELLING OR OTHERWISE DEALING WITH SECURITIES/COMMODITIES OR ANY OTHER INSTRUMENT WHATSOEVER.

No comments:

Post a Comment